social security tax limit

Web Meanwhile the earnings-test limit is much higher for those reaching FRA within the year. The wage base limit is the maximum wage thats subject to the tax for that year.

Social Security Tax Limit Wage Base For 2022 Smartasset

The 2021 tax limit is 5100 more than the 2020.

. Web In 2023 the Social Security Administration SSA wage base will increase from 147000 to 160200. Web 9 rows This amount is known as the maximum taxable earnings and changes each. Web Social Security functions much like a flat tax.

Web What is the income limit for paying taxes on Social Security. That is workers paying into the system are taxed on wages up to this amount. Web Social Security tax limit 2023.

Web Fifty percent of a taxpayers benefits may be taxable if they are. 31 can earn up to. In 2022 for example those who will reach FRA by Dec.

However if youre married and file separately youll likely have to pay taxes on your Social Security income. Web For 2023 the maximum Social Security tax per employee is 993240 160200 x 62. Web There is a limit on the amount of annual wages or earned income subject to taxation called a tax cap.

Between 25000 and 34000 you may have to pay. Keep in mind that this income limit applies only to the Social Security or Old-Age Survivors and Disability Insurance. For every 2 you exceed that limit 1 will be withheld in benefits.

In 2022 the maximum wage base is 147000 and its slated. This maximum applies to employers as well. Web Not everyone knows this but the government doesnt collect Social Security taxes on all income.

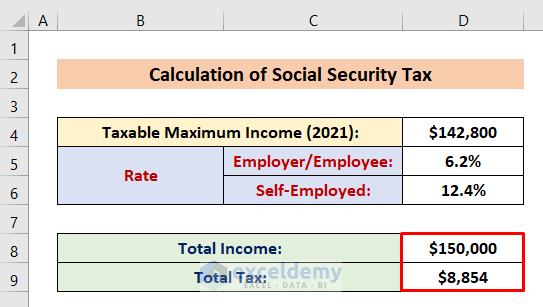

Web You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. The Social Security taxable maximum is 142800 in 2021. This limit is adjusted annually.

Web The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. Web The social security tax limit is the maximum earnings subject to the Social Security tax. Web In 2022 the maximum earnings subject to Social Security taxes was 147000.

Web And Donald Trump stated if re-elected he would permanently eliminate the employee payroll tax thus completely exhausting the Social Security trust fund by 2026. Web Unlike many other tax cap limits this stands as an individual limit. As of 2021 a single rate of.

In 2022 the maximum amount of income subject to the Social. Web What Is the Social Security Tax Limit. The exception to this dollar limit is in the calendar year.

Web The 2022 limit for joint filers is 32000. This new limit means employers can stop withholding Social. In 2022 only the first 147000 is subject to these taxes and in.

Web Wage Base Limits. If a couple is married each person would have a 147000 limit. Web For 2022 the Social Security earnings limit is 19560.

Web The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. The 2018 limit was 128400. Web 1 day agoSocial Securitys Maximum Benefit will also rise.

The OASDI tax rate for wages in. Filing single single head of household or qualifying widow or widower with 25000 to 34000. Only the social security tax has a wage base limit.

Those who are set to retire in 2023 at the age of 62 could see a 208 dollar increase to their social security benefits. Everyone pays the same rate regardless of how much they earn until they hit the ceiling. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to.

For money earned in 2023 the taxable maximum is 160200 which is nearly a nine percent increase from 2022. Web 2 hours agoAt the inception of Social Security nearly a century ago the maximum wage base was a mere 3000.

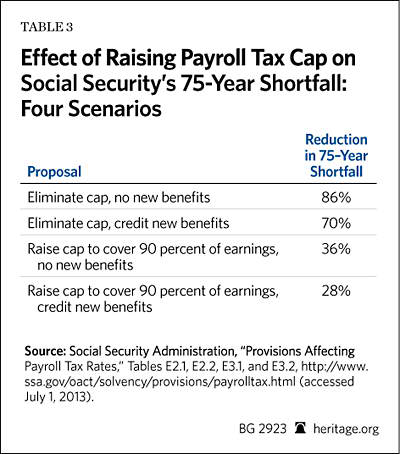

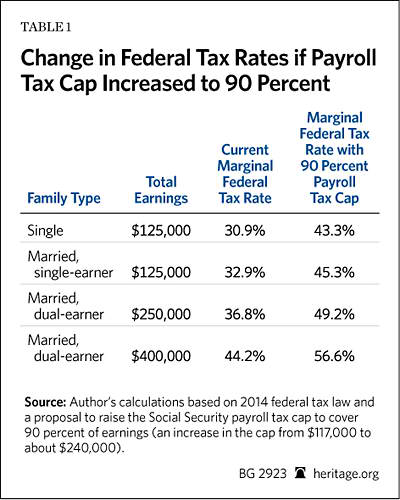

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation

Social Security Tax Impact Calculator Bogleheads

Maximum Social Security Tax In 2021

Social Security Payroll Tax Cap Change Could Boost Struggling Benefits Program Don T Mess With Taxes

Social Security Tax Limit 2022 And Exemptions Explained

What S The Social Security Payroll Tax Limit For 2022

The Evolution Of Social Security S Taxable Maximum

Column The Rich Have Already Paid All Their Social Security Tax Los Angeles Times

Avoiding The Social Security Tax Trap Barron Financial Group Llc

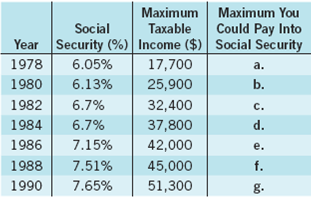

Solved The Table On The Right Gives A Historical Look At Social S Chegg Com

81 Years Of Social Security S Maximum Taxable Earnings In 1 Chart The Motley Fool

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation

Social Security Tax Limit For 2022 Explained Fingerlakes1 Com

Who Pays If We Raise The Social Security Payroll Tax Cap Center For Economic And Policy Research

How To Calculate Social Security Tax In Excel Exceldemy

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

:max_bytes(150000):strip_icc()/iStock_92129291_MEDIUM.social.security.bldg-e5e3b3bde3db445ab7edf3bb24fd255a.jpg)